The headlines this week were dominated by tough rhetoric at the United Nations session regarding Geopolitical issues, with an emphasis on North Korea. The situation is concerning, without a doubt, and presents risks of great proportions. It’s been an issue for 7 decades but seems to be reaching a boiling point. That said, perhaps the most significant thing that occurred this week was the announcement that the Fed, for the first time, plans to begin the process of unwinding its $4.5 Trillion balance sheet, which was the result of aggressive policies to defend against the Financial Crisis 9 years ago to the date. It was a very risky and controversial quantitative easing experiment that took place under then Fed Chairman Ben Bernanke’s leadership. By most accounts, it worked. But not everyone believes that. The US Economy avoided a multi-year depression. The US Stock Market has nearly tripled in value. Taxpayers and investors made money on the experiment. Both the tactic and the length of time have been debated since day 1, and the debate continues.

Fighting the Financial Crisis

To combat the crisis, the Fed launched a couple of rounds of quantitative easing to help unclog the financial plumbing. The Fed bought troubled mortgages as well as Treasury bonds in order to increase the money supply, cut interest rates, keep borrowing costs low and help prevent further defaults. The Fed was a huge buyer of bonds in the open market which instilled confidence at a time when there was very little. Over the years, the Fed kept buying additional assets when the debt securities matured. It took the proceeds and kept buying new debt to keep interest rates low and ensure stability in lending. The result is a $4.5 Trillion bond portfolio. The make-up of the portfolio is $2.5 Trillion in Treasuries and $1.8 Trillion in mortgage-backed securities with the balance in other scattered assets.

Part of the Fed’s goal back then was to encourage investors to take a little more risk. The S&P is up 270% since the 2009 lows, making this current Bull Market the second largest and longest in US history. But investors who stayed in cash or bought CDs were disadvantaged. Now, for the first time since the crisis, the Fed will stop purchasing new assets with the proceeds from maturing securities. It is a passive strategy and something the Fed has signaled for quite some time. It’s yet another step towards normalcy in the aftermath of the Financial crisis 9 years ago. To be clear, the Fed is not selling any securities, something that would have a much greater impact, both mechanically and psychologically. But it’s no longer buying either.

A Really, Really Big Number

The Fed has never had a balance sheet this large in American history. It was $900 Billion pre-crisis. That in and of itself is a really big number. $4.5 Trillion is a massive sum of money. In other words, it’s $4.5 Million Millions. It also adds up to $13,000 for every American. How about that for perspective? The Fed’s goal is to get its balance sheet gradually down closer to $3 Trillion by 2020.

The process of unwinding its balance sheet could prove to be a little bumpy and isn’t without risk. In addition to the asset roll-offs, the Fed indicated its intent to raise interest rates one more time this year, three times next year, twice in 2019 and once in 2020. A lot will happen between now and 2020, but that’s the current plan. Central banks around the globe will be paying close attention, particularly in Europe and Japan who followed the Fed with aggressive monetary policies. The ECB and BOJ are still buying bonds today.

How this Fed unwind goes is anyone’s guess. Global markets were rattled in 2013 when the Fed started merely tapering the rate of its money supply injections. Interest rates spiked and global stock markets sold off. The Fed does not like to be the source of panic. Because of this, a very cautious path has been carved out for the balance sheet unwinding. There really is no case study to use to compare because it has never happened before. Taking such a large buyer out of the mix will have consequences, but the financial plumbing is so much healthier now. Fed Chair Janet Yellen said there is a high bar in place that would force a return to purchases. She said it would take a major shock to the system to switch gears and provide stimulus to the economy. Keep in mind, it remains unclear whether Janet Yellen will even be at the Fed after her term expires in February. So far, the Market has been taking it in stride, knowing this was coming for quite some time. But the actual doing is the most important part. Strategy and preparation are important, but it’s all about execution. As the great philosopher, Mike Tyson once said; “Everyone has a plan until you get punched in the mouth.”

We will be studying this very closely. We do expect some more bumps ahead. When the facts change, so do we.

Have a nice weekend. We’ll be back, dark and early on Monday.

Mike

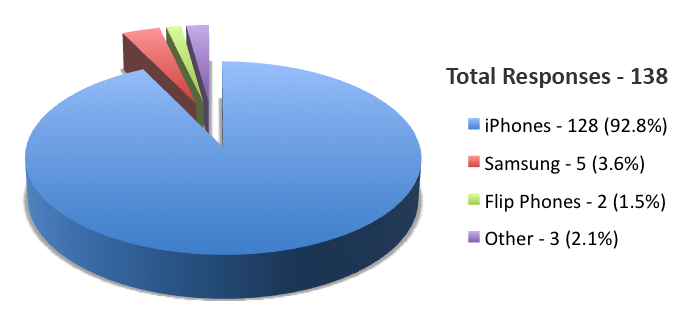

The results are in from last week’s unscientific iPhone survey.

Despite only having 15% of global market share and 34% of the US market, over 90% of our survey responders own an iPhone.

Thank you to everyone who responded!

The numbers look like this: